Scams are everywhere – and we mean everywhere. Scammers lurk in every corner of the internet, and if you spend any time online, you have probably been targeted. Maybe not successfully, but targeted all the same.

This guide is not about memorizing scam types or keeping up with the latest scam trends. That can quickly become overwhelming and feel impossible to keep up with because the list of scams never stops growing. We’ve challenged ourselves to try to find things there aren’t scams for, and so far, we’ve come up empty.

Looking for a new puppy? There’s a scam for that.

Buying a used or classic car? That too.

Trying to contact support to get help setting up your new printer? Scammers are waiting.

Shopping online and finding an unbelievable deal? Check again.

Publishing your first book? Scammers are ready to help!

Found the love of your life on a dating app? Could be a scammer behind that profile.

Think you’ve found a hot investment opportunity on social media? There’s a good chance there’s a scam attached.

Booking a vacation, applying for a job, or renting an apartment? There are scams for all those too – and then some.

Instead of trying to memorize every scam, the safer approach is learning how to analyze any situation the same way a scam investigator would.

The State of Scams in 2026

At one time, scams felt a little more like isolated incidents. Today, scamming has become a full-blown industry of organized crime – a coordinated, global business that runs 24/7.

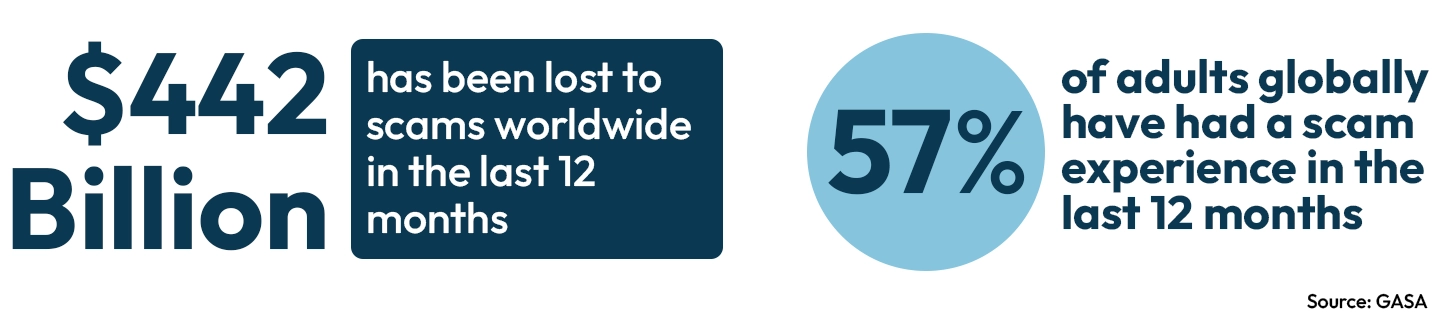

The Global State of Scams 2025 Report from the Global Anti-Scam Alliance (GASA) revealed a staggering $442 billion was lost to scams globally in the past 12 months – with 57% of adults worldwide saying they’ve personally encountered a scam during that time.

Entire overseas call centers operate around the clock with teams trained to run specific scams. Some specialize in fake tech support calls, while others focus on romance, investment, or government impersonation scams. In some regions, scam operations overlap with larger criminal networks involved in human trafficking and forced labor.

Beyond that, some scam networks operate like full-service businesses, managing scams related to book publishing, website design, trademark filing, and fake degree credentials. These groups register hundreds of shell companies and websites that appear unrelated on the surface, but are controlled by the same scam group behind the scenes. When one company is exposed, the scammers can quietly replace it with another, allowing the scam to continue under a new name.

Social media and AI have only fueled the fire. Scammers can clone voices, generate fake videos, and create convincing websites in minutes. Sponsored scam ads flood search engines and social feeds, and with so much of our personal data floating around online, it’s easier than ever for scammers to tailor their scam specifically to you.

"Just Be Careful" Is Not Enough

Scammers have become masters at social engineering. They mirror the brands you trust, replicate the websites you visit, spoof phone numbers, and speak with enough confidence and authority that you don’t feel the need to question what’s happening.

Because of that, simply being careful is not enough anymore. You can be intelligent, tech-savvy, and skeptical and still get caught off guard. Not because you are careless, but because scammers have turned manipulation into a science. They work around logic by using emotions – often fear, urgency, and confusion – to push you into acting before you have time to think.

That’s why the phrase “I’d never fall for that” is so dangerous. Scammers expect people to feel confident they won’t be a victim of a scam, but when the message arrives at the right moment with the right amount of pressure and urgency, even a cautious person can be pushed to react instead of pausing to verify.

Instead of just being careful, the smarter move is to slow down and investigate. Even if the situation seems urgent, resist the urge to act immediately. Treat every situation with caution, especially anything involving money or personal information. With that in mind, here’s how you can start analyzing potential scams like a scam investigator.

How to Analyze a Situation Like a Scam Investigator

Most scams don’t hinge on a single, obvious red flag. Because of this, scam investigators will not typically make decisions based on one detail alone – they make an effort to identify multiple inconsistencies, the kind that usually only appear when you slow down and dig deeper.

At the core of scam investigation is one habit: independent verification.

If someone makes a claim that sounds official or serious, don’t take it at face value. Whether it’s a message about an account issue, a tax refund, an unexpected charge, a missed payment, a job or investment opportunity, or a package delivery, take steps to independently verify the claim before acting.

Never rely on links, phone numbers documents, or instructions provided by the person contacting you.

Instead:

Search the organization directly through a search engine to find the legitimate website (be sure to avoid sponsored ads – they are frequently abused by scammers)

Call the official number listed on the legitimate website, billing statements, or the back of your credit or bank card

Search the company name + “scam” or “complaints” to see what comes up

If you are contacted by phone:

Don’t feel pressured to handle it right away. Ask for a case number or reference ID, hang up, and call the company directly by manually dialing a verified number (don’t trust caller ID or redial from recent calls). Scammers hate when you do this – they will insist you handle it immediately. Real representatives will always understand your need to confirm authenticity.

1. Start with the Story, Not the Sender.

Forget who is contacting you for a moment – focus on what they are saying. Most scams have a storyline driven by emotion or urgency. Try to identify the emotion being used in the message you receive:

- Excitement: “You’ve won a prize! Act fast to claim it!”; “You’ll make your first million in 3 months with this new investment technology!”

- Fear, Urgency, and Authority: “This is your bank fraud department calling about a problem with your account.” “This is your state department of transportation, you have an unpaid toll!”

- Guilt: “I need your help, I’ll pay you back.” “I need money pay for an emergency surgery.”

Scammers use emotion to override logic, but if you can identify what they want and why they want it, you can start to figure out if the story holds up.

Ask yourself:

🚩Does this story even make sense to me?

Are they referencing something I actually signed up for, purchased, or did?

🚩Are they trying to scare me into acting?

Are they claiming hackers, identity theft, account breaches, or suspicious activity that requires immediate action?

🚩Why is this happening right now?

Is there any logical reason this situation would occur today or out of the blue?

🚩What is the end goal? What do they want me to do next and why?

Every scam leads to a request. Are they asking you to click a link, download software, pay for something, share information, or verify your identity?

🚩Would a real organization handle the issue this way?

Banks never ask you to verify account information via text. Law enforcement never demands payment through gift cards or cryptocurrency. Real employers will not send you money and then ask you to send some of it back.

🚩What happens if I say no or do nothing?

A legitimate situation will still be there tomorrow, but a scam will often collapse when the urgency is removed.

2. Check the Source

Once you examine the story, turn your attention to the source. Scammers can make emails, websites, and even phone numbers look legitimate at first glance. That’s why verification means digging a bit deeper.

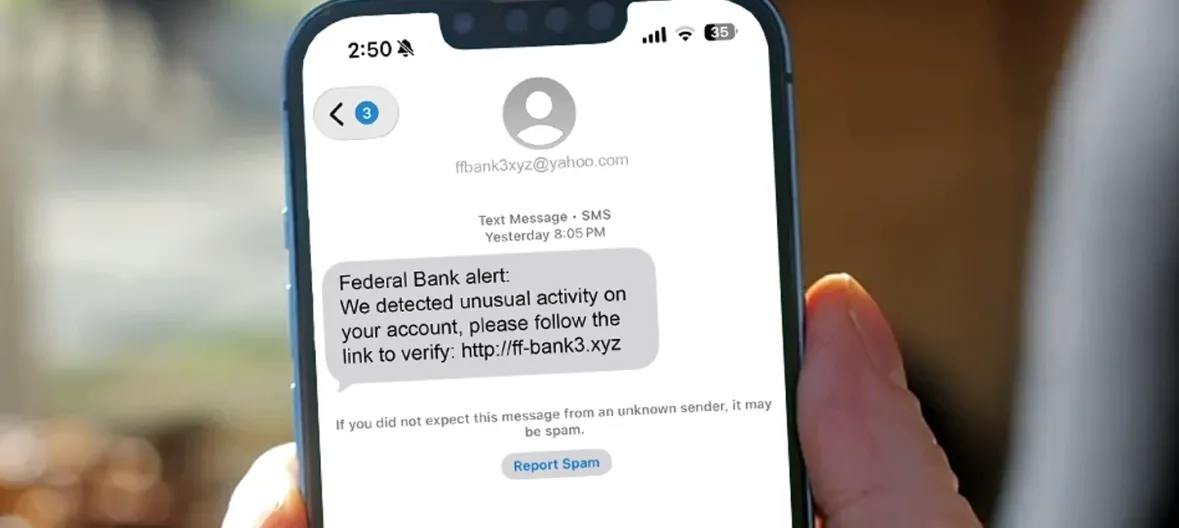

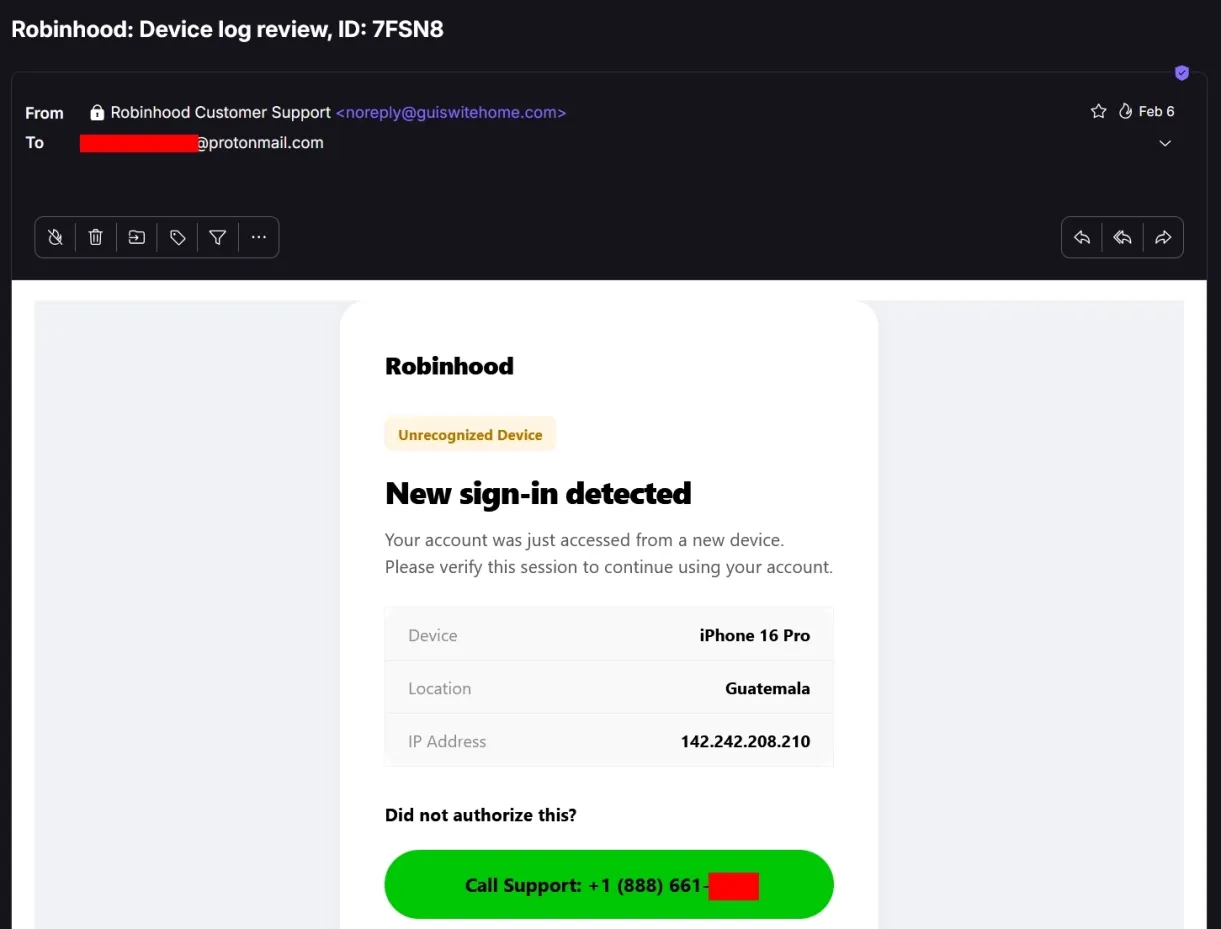

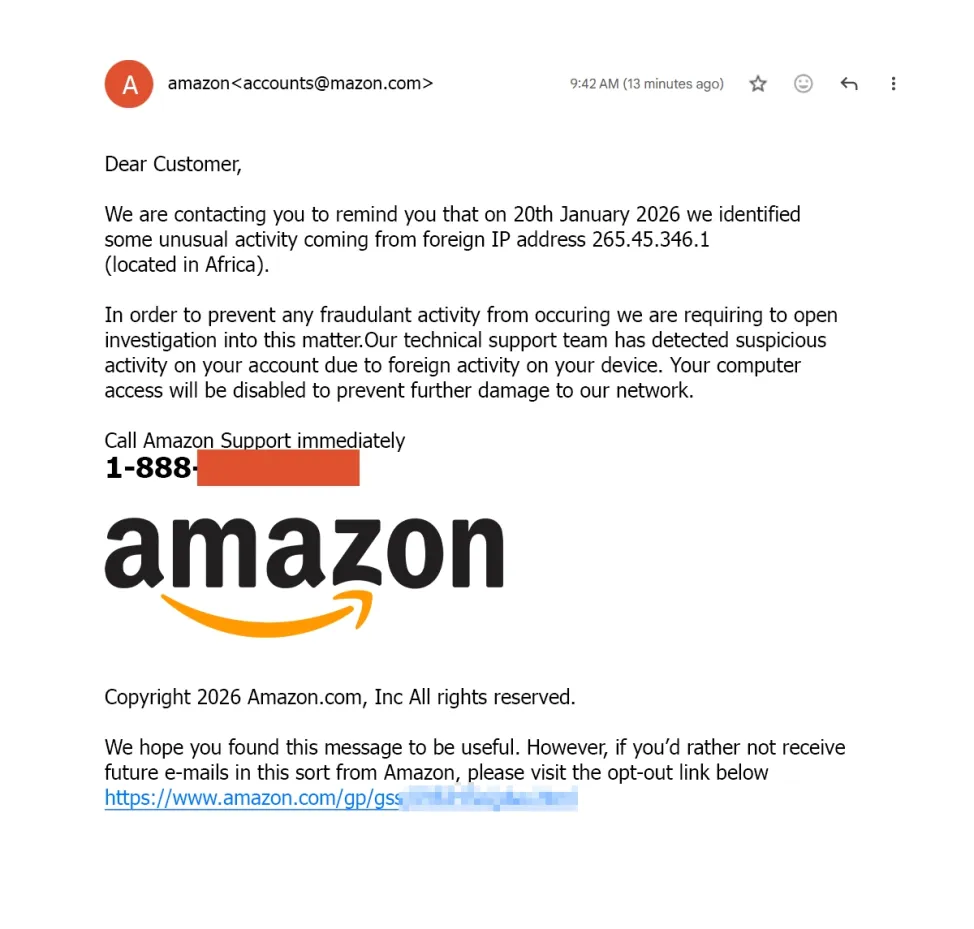

Email domains: Real companies do not conduct official business from free email services like @gmail or @outlook addresses. Carefully inspect the sender information for subtle variations like extra words or dashes. Always cross-check the email against contact information listed on the organization’s real website and support channels, not the one linked in the message.

Phone numbers: Never rely on caller ID to protect you. Scammers can spoof numbers to make it look like they’re calling from your bank, a company, or even local law enforcement. If there’s any uncertainty, hang up and call the organization directly using a verified number from their website or the back of your card. Never use your call history to call back the number that contacted you or use a number they give you.

URLs and links: Like email domains, scams can be tough to spot if you don’t know the real URL, but check for subtle misspellings or added words. Always hover over links before clicking to see the destination. Avoid logging into accounts via links sent through email. Instead, manually type in the website address.

3. Reputation Investigation

Before you trust any company, person, or website, check what others are saying.

Search the name + “scam” or “complaints.” Are complaints scattered across different platforms? Do the stories sound similar even when posted by different people? Are the same issues mentioned repeatedly over time?

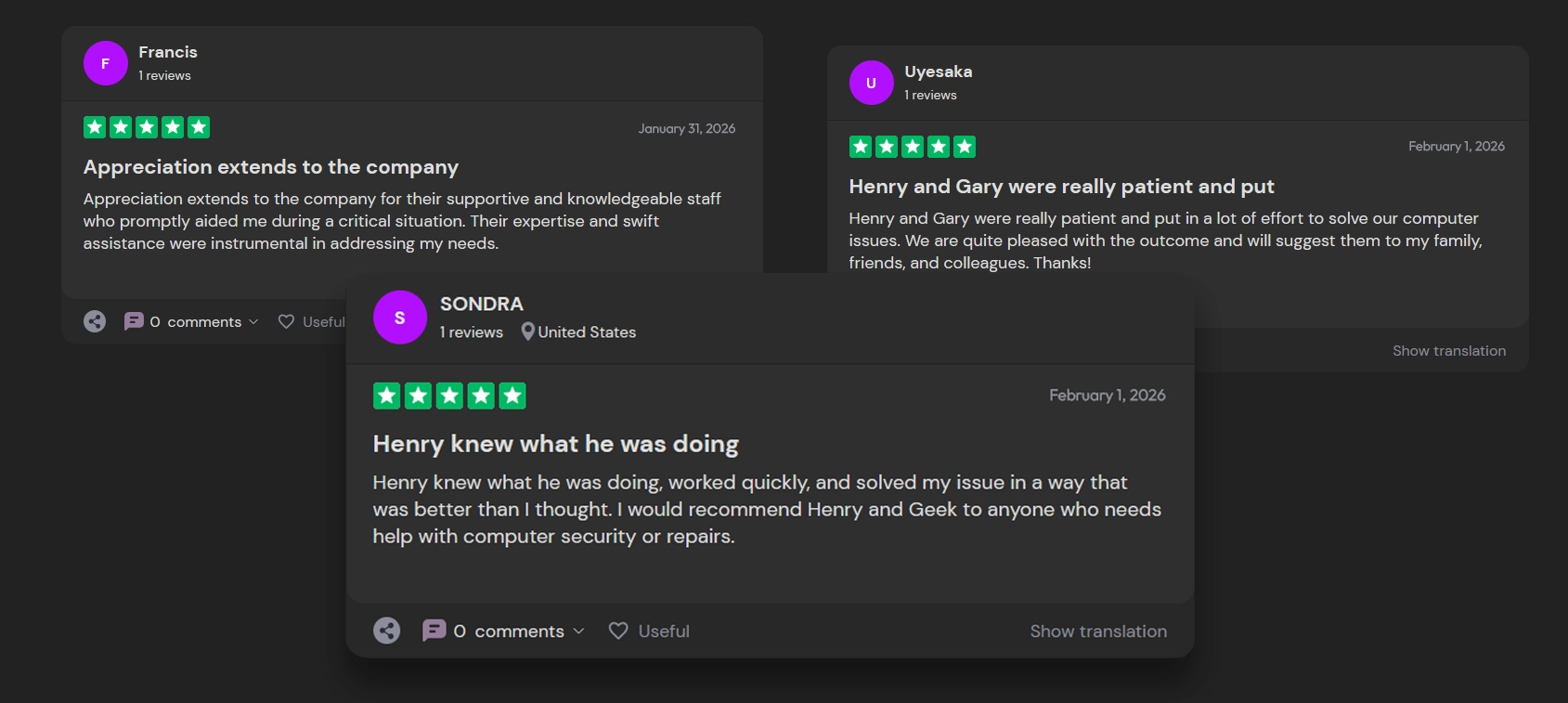

Search the name + “reviews.” Look for reviews across multiple platforms, not just testimonials they show you,, and be extra cautious of ones that seem too perfect. Scammers know how much people rely on reviews which is why they flood platforms like Trustpilot and Google Reviews with fake 5-star ratings to bury their scam. Watch for multiple glowing reviews in a short time frame, generic language, identical phrases repeated across different accounts, and review profiles that have no history beyond that one company.

Search the business name on consumer protection agency or association websites to see if any scam alerts appear.

Social media presence: Low effort scams will not always have social media presence but others use it as a tool to build their scam. Check posting history, followers, and engagement for suspicious signs. Are posts consistent and professional or repetitive and vague? Does the account have thousands of followers with little interaction? Is account engagement organic or full of generic bot or AI-generated posts?

If you find nothing – no reviews, no mentions, no history – that’s often a sign it’s newly-created or fake.

A quick note: While the Better Business Bureau (BBB) can be an useful resource, it’s important to understand what it is and isn’t.

The BBB is not a government agency or a regulatory body. The ratings shown and accreditation are based on information provided by businesses and consumer complaints, and participation in accreditation is voluntary. Because of this, BBB ratings do not always reflect the full picture of a company’s behavior.Some scam operations may reference the BBB, misuse its branding, claim affiliation with, or even appear in its listings to seem more legitimate. For that reason, the BBB is best used as a data point, not a definitive stamp of trust.

4. Examine Websites & Documents

Examining Websites

Scammers, especially with the help of AI, can build convincing websites to support their story with very little effort. They might have official logos, glowing testimonials, company partnerships, and an overall professional presence, but appearance alone means very little. Verification usually means checking what sits behind the upfront presentation. Here are a couple of quick website checks you can do:

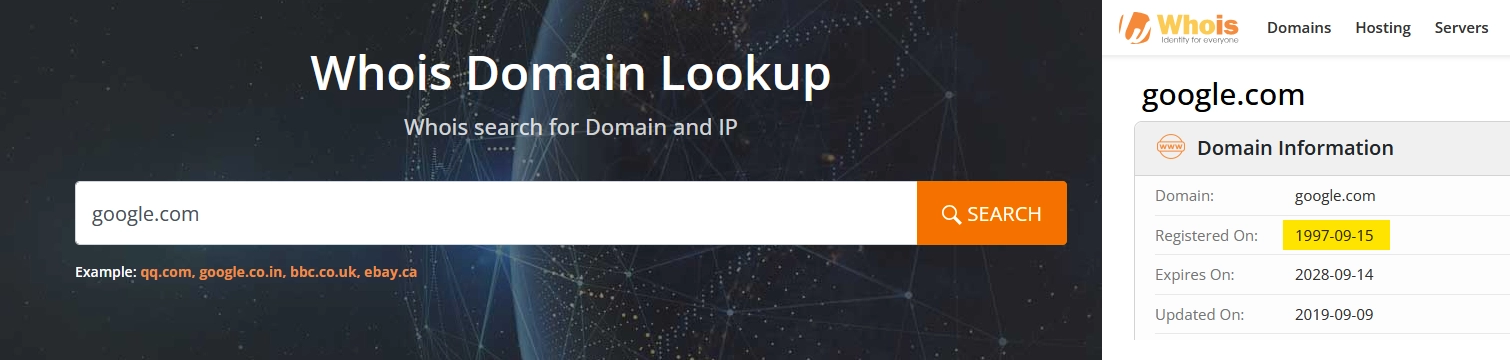

Check the website age. A quick WHOIS lookup can reveal a lot. Use it to check when the domain was registered. A website that popped up last week is unlikely to belong to a trusted financial institution, government agency, or legitimate investment opportunity.

Investigate the company address. Search the address listed on the site. Scam operation sometimes use virtual or Regus offices shared by many unrelated businesses. Google Street View can reveal inconsistencies, such as a “company” operating out of a mailbox store, residential home, coworking space, city hall, or an empty building.

Search the company phone number. Scam numbers are often reused across dozens of unrelated sites or appear in scam reports and complaint forums. A legitimate business’s number should consistently tie back to that organization.

Look at links and social media. Check whether links actually work. Broken pages or inactive social media accounts may indicate the site was quickly built to support a scam.

Examining Documents

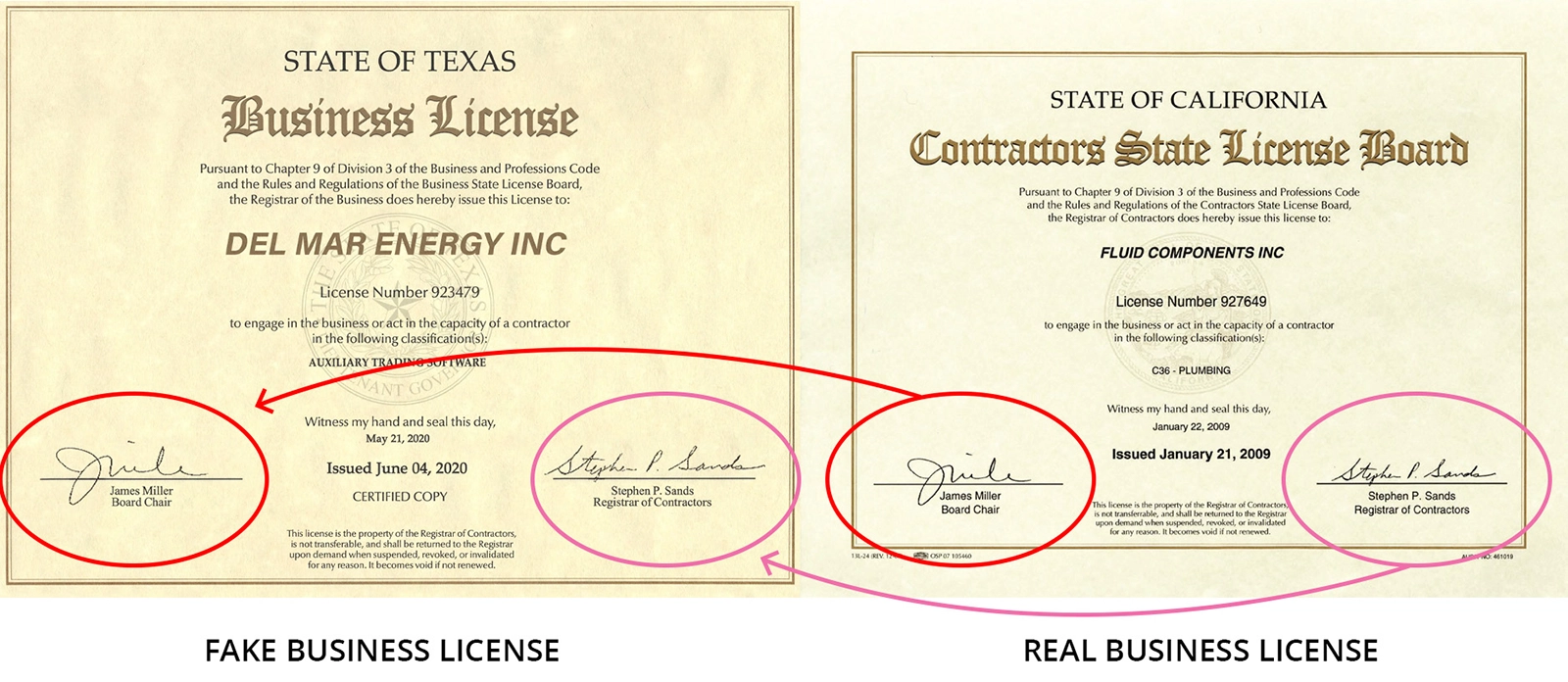

Depending on the scam, scammers love to throw around official-looking paperwork – contracts, certificates, government forms, business licenses, and awards. They might look legit at first glance, but with AI tools and Photoshop, it’s easier than ever to fake this sort of thing. These scams are usually more sophisticated and might require you to dig a little deeper.

Check the basics - fonts, formatting, and quality. Look for inconsistent fonts and spacing, misaligned margins or low quality logos and seals.

Scrutinize names, signatures, and titles. Look up the names of people who signed or issued the document. If it claims to be from a government office, investment firm, or legal department, see if that person actually exists. Try to cross-reference that name with other licenses.

When in doubt, get another opinion. If a document claims to come from a bank, employer, government agency, or service provider, do not open it directly. Instead, independently contact the organization using a verified phone number or website and ask whether the document is real.

A quick note: Use extreme caution with documents, especially if they come from an unknown or suspicious source. Scammers can booby-trap PDFs, .zip, .docx, .pptx, and .xlsx files to contain malware (viruses, Trojans, malicious code) that activate when the file is opened and infect your device. A .zip file that requires a password is a huge red flag as scammers can use it to encrypt the data to evade antivirus software.

5. Test the Communication & Ask Questions

This is one of the simplest and most revealing checks you can do. When you are unsure about a message, start asking questions.

Ask for credentials and a case number. “Can I get your name and department? “Can you provide me with a case or reference number?” “I’ll call you right back using the number from the official website."

Ask for something verifiable. “Can you send this request in writing through your company’s official email?” “Can you provide an official notice or reference number?”

Ask for time. “I need a few minutes to verify this.” “Let me call you back after I confirm with my bank.” “I don’t make financial decisions over the phone, can you send this information another way?”

A real company or financial institution won’t push back, but a scammer will deflect, pressure, and guilt-trip you. Some even get aggressive or insult you. That shift in tone will tell you everything you need to know.

6. Watch for Escalation

No matter how it starts, every scam eventually escalates toward at least one of three goals. They want:

Your money

Your personal information

Access (to your computer, phone, or accounts)

Know the endgame. If they want money, they’ll push for gift cards, wire transfers, or cryptocurrency – anything irreversible or impossible to trace.

If they want your information, they’ll frame it as “verification.”

If they want access, they will guide you into installing remote access software so they can connect to your computer or phone.

Once they achieve any of these, scammers can easily pivot toward more serious theft or long-term exploitation.

If the conversation starts innocently but moves toward payments, personal data, or requests to use your computer to install software or share screens, stop immediately. Don’t explain, argue, or say you suspect it’s a scam because it can provoke retaliation. Simply end the interaction and block the sender. If you granted remote access, disconnect your device from the internet immediately until you can remove the software.

The New Normal: Don’t Trust, Verify

It might sound harsh, but here’s the unfortunate reality: you can’t trust anything you see online any more. At one time, the internet felt like it was built around discovery, but now, it can feel like it’s built around deception. Every platform is crawling with fake accounts, fake reviews, fake websites, and fake opportunities.

That doesn’t mean you need to live in fear. It just means treating what you encounter online with healthy skepticism until you can verify it – especially if it involves money or personal information.

When you get an unexpected message or call – assume nothing.

When you see an offer that seems too good to be true – assume it is.

When someone online asks for your time, trust, or access – assume they need to earn it.

Think of skepticism the way you think of seat belts or locks. You use them not because you expect something bad to happen, but because it’s smart to be prepared and protected if it does.

The single safest mindset you can have online today is:

Trust nothing until it proves itself trustworthy.

– The Seraph Secure Team

The habit of pausing, questioning, and verifying gives you a fighting chance against online scammers, but you don’t have to do it alone – Seraph Secure can help. Our anti-scam software runs quietly in the background of your computer, automatically checking the age of websites, blocking remote access attempts, detecting fake virus pop-ups, and protecting against hundreds of thousands of known scam websites.

Check out Seraph Secure’s full list of features and start your free trial today!