Refund Scams

In the ever-evolving landscape of online scams, refund scams have emerged as a pervasive and deceptive threat. These fraudulent schemes, often masquerading as reputable companies or organizations, aim to exploit unsuspecting individuals by tricking them into believing they are due a refund for an alleged purchase or over-payment related to a service.

The Anatomy of a Refund Scam

The Unsolicited Approach: Refund scams typically commence with unsolicited communication, which can take various forms, such as emails, text messages, or phone calls. These initial contacts serve as the bait, with scammers claiming that you are entitled to a refund. This initial interaction is designed to instill trust and engage the victim's attention.

Gaining Trust: To gain the victim's trust, scammers offer to process a refund on their behalf. In doing so, they request access to the victim's computer using remote connection software, a ploy designed to make the scam appear legitimate.

![Screenshot of a text from an unknown number, with message "Your IRS tax refund is now available. You must accept within 24 hours: [link redacted]"](/assets/656775d057c6907c190b19e4_refund-text-p-500.jpg)

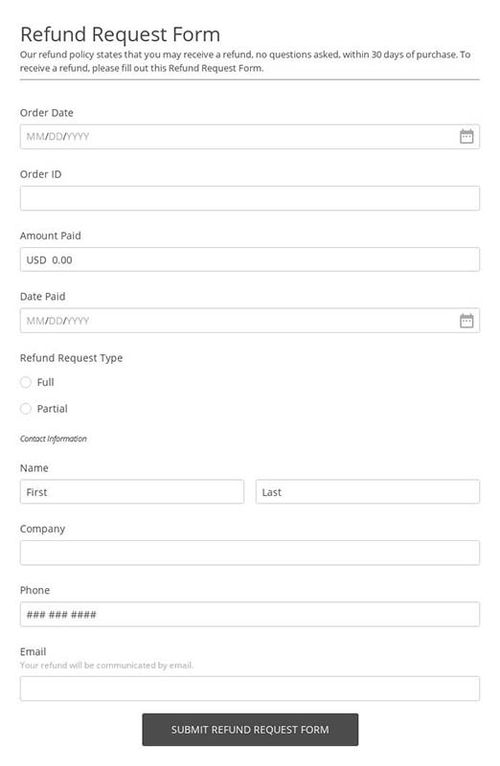

Personal Information Request: Once the remote connection is established, victims may be asked to complete a supposed "cancellation form." This form usually includes a range of sensitive personal and banking information, a treasure trove for identity theft and future fraudulent activities.

Manipulating Screens: With the cancellation form completed, the victim is directed to log in to their bank account to verify that the refund has been processed. At this point, scammers reveal their devious expertise by manipulating the victim's screen temporarily. The screen alteration creates the illusion of an excessive amount being deposited, setting the stage for the final act of the scam.

The Excessive Refund: The victim is informed that the refund includes an excess amount and that this surplus must be returned to the scammer. This maneuver is often executed by requesting that the victim send funds via wire transfers, gift cards, or, in some instances, Bitcoin ATM deposits.

If you find yourself in a situation involving a refund offer, it is advisable to verify the authenticity of the situation independently. Reach out directly to the legitimate company or organization through their official contact information, which can often be found on their official website.

WHAT TO LOOK FOR

Unsolicited emails, text messages or phone calls from an unknown sender.

Refund notification for a transaction you don’t recognize.

Requests for personal information.

Request for remote access to your computer.

Request to fill out a cancellation form.

Payment request in the form of a wire transfer, gift cards or through cash in a box through the mail.

WHAT YOU CAN DO

Verify the legitimacy of the organization through their websites and phone numbers.

Carefully inspect the sender’s email and phone number.

If you receive a refund notification look up the official contact information for that company and contact them directly.

Do not provide any personal or financial information.

Do not allow remote access to your computer.